|

Craig Steiner, u.s. Common Sense American Conservatism |

|

|

About Me & This Website My Positions On Facebook Contact Me Articles |

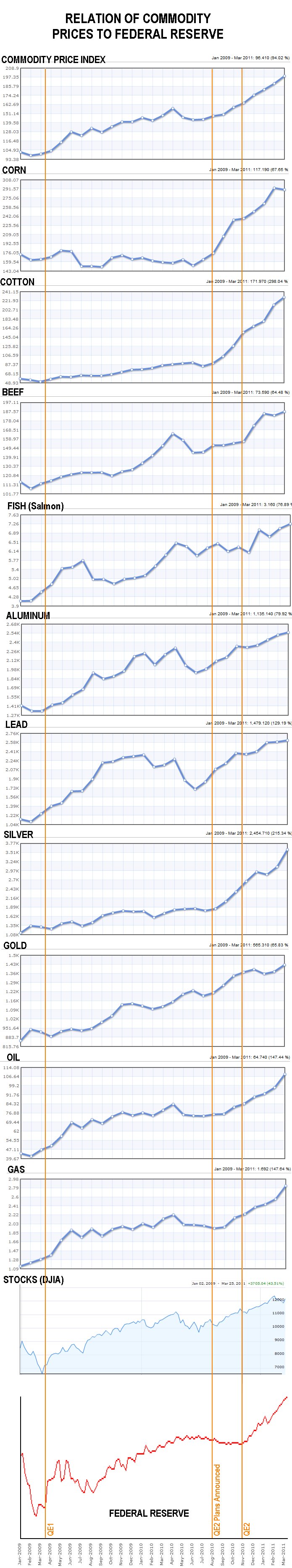

Back in 2008 prices of gold, silver, and other commodities were all decreasing or flat while the price of oil was rising--so a case could be made that oil's movements were abnormal and possibly attributable to speculation. Not a conclusive case, but at least a case. Of course, demand for oil was increasing so an increase in prices was to be expected. That does not automatically mean speculators had no impact and doesn't automatically mean that demand was the exclusive cause of the oil spike. But the price movements in oil at least appeared to move in line with the laws of supply and demand. Perhaps speculators exacerbated that move. Not now. There is currently ample supply and insufficient demand for oil in the world. On Monday, Saudi oil minister Ali Al-Naimi confirmed to a roundtable of Asian energy ministers gathered in Kuwait that Saudi Arabia had cut output to 8.3 million barrels in March, from 9.1 million barrels in February, due to lower demand. There is more than enough oil on the world market. In fact, nobody was buying all the oil that's being produced, so to avoid oversupply Saudi Arabia cut its oil output. Normally when there is too much supply and insufficient demand, prices drop. That's not what's happening right now, though. In spite of too much supply, the price of oil is continuing to rise. Speculators, right? I doubt it. That would mean speculators are betting against the market; they'd be betting prices will go up when insufficient demand would be working to drive prices down. Betting against the laws of supply and demand would be a very dangerous bet for speculators to make, and I seriously doubt they're making that bet. Enter the Federal Reserve Rather than speculators, the Federal Reserve, president, and Congress are to blame for rising prices. As I've written about many times as far back as March 2009 (here, here, here, here, here, here, and here, to name a few), the Federal Reserve has been--and continues--to print money to pay for our annual federal deficit. They call it "quantitative easing" but that's a modern euphemism for "printing money" that makes it sound less bad. Kind of like how Obama has decided that "the war on terror" is now an "overseas contingency operation." And "war" is now "kinetic military action." And "tax hikes" are now "spending cuts in the tax code." In that same vein, "quantitative easing" is the Orwellian name for the age-old self-destructive scheme of governments debasing their currency. In the old days this actually required the government to reduce the amount of precious metal in their coin. If the government wanted to debase its currency, it would mix in more "filler" with the gold or silver so they could magically produce money out of thin air (here's a great article about inflation and the debasement of currency in the Roman Empire). Today, the Federal Reserve just prints money out of thin air. Heck, it doesn't even print it anymore. It just adds billions and trillions of dollars to its bank account balance--the ultimate computer hacker stealing money from the public by changing a few bits of data on a hard drive. When there is more money chasing the same goods, the laws of supply and demand ensure that prices will rise. With an increasing supply of dollars and the same amount of goods, the increase in prices will be observed--all other things being equal--in all goods that are priced in dollars. This includes oil, gold, silver and most other commodities where we're seeing inflation. Is The Federal Reserve Really To Blame?  The Federal Reserve's money-printing is almost definitely to blame. If it were just the price of oil that was spiking (as was mostly the case in the summer of 2008) then it wouldn't be fair to draw an automatic conclusion that it was the Federal Reserve. But as can be seen in the graphs to the right, it's not just the price of oil that's increasing. Commodities in general have increased 94% since January 2009, corn has increased 68%, cotton 298%, beef 64%, salmon 77%, aluminum 80%, lead 129%, silver 215%, gold 66%, the stock market 43%, oil 147%, and the price of gas 147%. Given the weak condition of our employment market, these prices aren't being driven by hugely recovering demand. Instead, as the charts to the right show, these increases in prices strongly track the Federal Reserve amassing assets by printing money (click the graph to open a larger, more legible version of the chart). The first vertical orange line marks the beginning of QE1 in March 2009, the second orange line is in August 2010 when the Federal Reserve indicated it was planning a second round of money printing, and the third orange line is in November 2010 when the Federal Reserve actually began the money printing with QE2. As the charts indicate, the prices of these various commodities across the economy track the Federal Reserve's actions strongly. While some did not show a strong reaction to QE1, most reacted to the August 2010 announcement of an upcoming QE2, and all of them have increased since QE2 began last November. Despite President Obama's rhetoric, the increases in the prices of corn, cotton, beef, fish, aluminum, lead, silver, gold and the broader stock market are not due to speculators in the oil market. The rise in prices isn't just oil. Rather, there is a wide-scale increase in prices across the economy. This is known as inflation and, as the chart to the right indicates, it has been caused by the Federal Reserve. Entirely Predictable Of course, a chart and statistics can be used to draw any conclusion one wants after the fact. But the inflation we're seeing in oil and other commodities was entirely predictable. In fact, I (and many others) did predict this. As long ago as February 2009--before the Federal Reserve even announced the first round of post-TARP money printing--I predicted that we would pay for Obama's stimulus package by "borrow[ing] the money we can borrow... and print[ing] the rest. Get ready for some inflation and/or a devaluation of the dollar..." In March 2009, after the Federal Reserve announced it would be printing money for six months, I predicted "In order to continue funding the deficit spending, it's a pretty safe assumption that the Federal Reserve will end up printing some more money after that." In November 2010, as predicted, the Federal Reserve did indeed start printing more money. I also wrote in the same article: In November 2010 I wrote: That means that everything we import (which seems to be close to everything) will become more expensive. Of special interest would be a skyrocketing price of oil. Since we import most of our oil, a weaker dollar would mean we'd have to pay more for oil. Since everything we buy requires energy to produce and transport, higher oil prices lead to higher prices of just about everything--including food. We're now seeing exactly that: Skyrocketing prices of oil in the absence of a meaningful recovery, and increasing prices on just about everything else. And all along the way, many of us have been predicting that this would debase the dollar and create inflation. Meanwhile, "expert economists" and Federal Reserve Chairman Bernanke have been claiming that we can pretty much print as much money as we want as long as unemployment remains high--that we can't have inflation with such high unemployment. That was until last month when Bernanke stated that the rise in oil prices "could lead to weaker growth and higher inflation." Wow, ya think? It's almost like the chairman of the Federal Reserve actually started reading some conservative economic commentary from, oh, two years ago and a light-bulb switched on. Death Spiral We are currently in the money-printing death spiral I described in March 2009. Getting out of the death spiral will be difficult. The only way out is to seriously reduce our deficit, and do it quickly. As long as we are running deficits so large that the government has to turn to the Federal Reserve as the lender of last resort, the Federal Reserve will continue to print money and our situation will continue to spiral out of control. Reducing our deficit enough to make a difference is going to be painful. Our government is going to have to become a lot smaller which will impact those employed by the government and those receiving government benefits, and that will subsequently impact the entire economy. And it's a tough time to do that. Cutting the size of government is something we should've done during boom years when our economy could absorb a gradual reduction in government spending. Now we'll be forced to implement a rapid reduction in government spending during a recession. It won't be pleasant. But the alternative is to continue on our current course of unsustainable deficit spending. This will necessitate QE3 which will, at the very least, cause inflation to skyrocket, interest rates to rise, unemployment to rise, home prices to decrease, and foreclosures to increase--by any measure an even worse recession than we just went through. At worst, it will so devalue the dollar that the world will finally decide to abandon it as a reserve currency--we'd probably be looking at oil and international transactions priced in an international currency. That would be a very different world, and one in which the United States would be much weaker. Obviously the Federal Reserve knows the consequences of a QE3 so I'm sure they'll put it off as long as possible. But that also means that when QE3 is announced, it'll be a good sign we're in big trouble. The Culprit of High Gas Prices There are three primary culprits for today's high gas prices, and none of them are speculators. The Federal Reserve is directly responsible for the rising prices of oil and other commodities. It is the Federal Reserve that has engaged in QE1 and QE2 and, as a result devalued our dollar which in turn raises prices of commodities such as oil that are priced in dollars. The ultimate responsibility, however, is Congress and President Obama. It is Obama and Congress that are causing the federal government to spend so much money that new dollars have to be printed to satisfy its borrowing needs. If the government weren't borrowing so much money, the Federal Reserve wouldn't be compelled to print money so we wouldn't be facing the price inflation we are facing in oil and other commodities. So if you want to see lower food and oil prices, contact your congressman, senators, and the president and demand they stop engaging in deficit spending. We can't afford it and we can't afford the damage inflation will do to our economy. Go to the article list |